When a tracked strategy on AlgoMart rebalances, you receive an email rebalance alert summarising what changed and strategy's assets (tickers) new allocations.

These emails are designed to be informational, structured, and neutral.

This article explains how to read a rebalance email, what each section means, and what (if anything) you should do next.

Why you receive a rebalance email

You receive a rebalance email because:

You are tracking the strategy

The strategy’s quantitative algorithm triggered a rebalance whether on periodic, active, or emergency conditions.

Allocations and simulated trades were updated

Rebalances typically occur:

Periodically (Monthly, Weekly, ..etc) or Actively under normal conditions depending in the strategy's design.

More than once in a month during certain market regimes.

Emails are sent only when a rebalance occurs automatedly , not on a fixed schedule.

Understanding the email headline

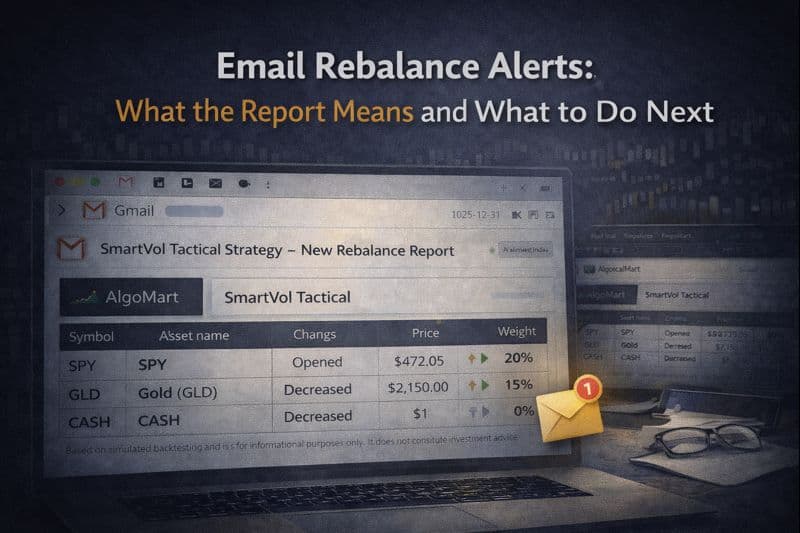

The subject line (for example, “SmartVol Tactical Strategy – New Rebalance Report”) indicates:

Which strategy rebalanced

That a new allocation report is available

The effective rebalance date

This headline confirms a structural update, not a performance event.

How to read the allocation table

The core of the email is the allocation table, which typically includes:

Symbol – the traded instrument

Asset name – full security description

Change – opened, closed, increased, or decreased

Price – reference price at rebalance

Weight – target portfolio allocation after rebalance

Important points:

“Opened” means a new allocation just took a position to replace a “Closed” position and the weight is always above 0% for an “Opened” position

“Closed” means an older allocation just closed a position and the weight always equal to 0% for a “Closed” position.

“increased” means an older allocation just increased a position's weight % and the weight always is always above 0% for a “increased” position.

“decreased” means an older allocation just decreased a position's weight % and the weight is always above 0% for a “decreased” position.

Weights represent model allocations, not executed trades

Prices are reference values, not execution guarantees

The table in the alert provides transparency into how the strategy evolved at that rebalance point

Emergency and regime notes

Some rebalance emails include a note such as: “This signal could be an emergency allocation triggered by bear market conditions.”

This indicates:

A emergency regime maybe was activated

If the email was for an emergency allocation, All previous trades/allocations will be closed and all new allocations will be Opened status

The change is part of the strategy’s automated design

What to do after receiving a rebalance email

In most cases, the correct response is to review, not react.

A sensible approach:

Read the allocation changes calmly

Check whether the behavior aligns with the strategy’s objective

Note regime or defensive transitions

You may choose to trade early in the next trading day using the strategy’s new allocation.

If you decide to act on the strategy’s rebalance report while tracking the strategy:

A) You may close any positions marked as “Closed” if you were previously allocated to those assets.

B) After closing previous positions, you may reallocate the entire strategy's invested value back into the strategy and open, increase, or decrease positions as indicated by weights percentages of total value. All AlgoMart strategies assume that returns from closed positions are reinvested within the same strategy into newly opened or adjusted (increased or decreased) allocations.

What not to do

Avoid:

Reacting emotionally to individual asset changes

Comparing the rebalance to short-term market moves

Over-monitoring between rebalances

Why these emails matter

Over time, rebalance emails help you:

Understand how strategies adapt across cycles

Observe consistency in rule-based behavior

Build confidence in long-term process

Take advantage of the strategy’s edge or value by allocating to it, if you choose.

Important note (informational use):

All AlgoMart rebalance emails, allocation tables, simulated trades, and strategy data are provided for informational purposes only. They do not constitute investment advice, recommendations, or execution instructions.

Users remain fully responsible for their own decisions and should consult qualified financial professionals where appropriate.