Choosing your first strategy on AlgoMart can feel overwhelming at first—especially when multiple strategies show long histories, detailed metrics, and different risk profiles.

This guide is designed to simplify that decision. Instead of starting with performance, it walks you through a structured checklist that helps you understand which type of strategy may be appropriate for your objectives, risk tolerance, and expectations.

The goal is not to “pick the best strategy,” but to choose one you can understand, monitor, and stick with.

Start with the right mindset

Before selecting a strategy, it’s important to set realistic expectations.

AlgoMart strategies are presented with historical simulations, metrics, and allocations to support independent evaluation. They are not recommendations, predictions, or guarantees. Different strategies are designed for different objectives, and each behaves differently across market conditions.

A good first strategy is one you can remain aligned with through both calm and volatile periods.

Step 1: Understand the strategy objective

Begin by reading the strategy concept carefully.

Ask yourself:

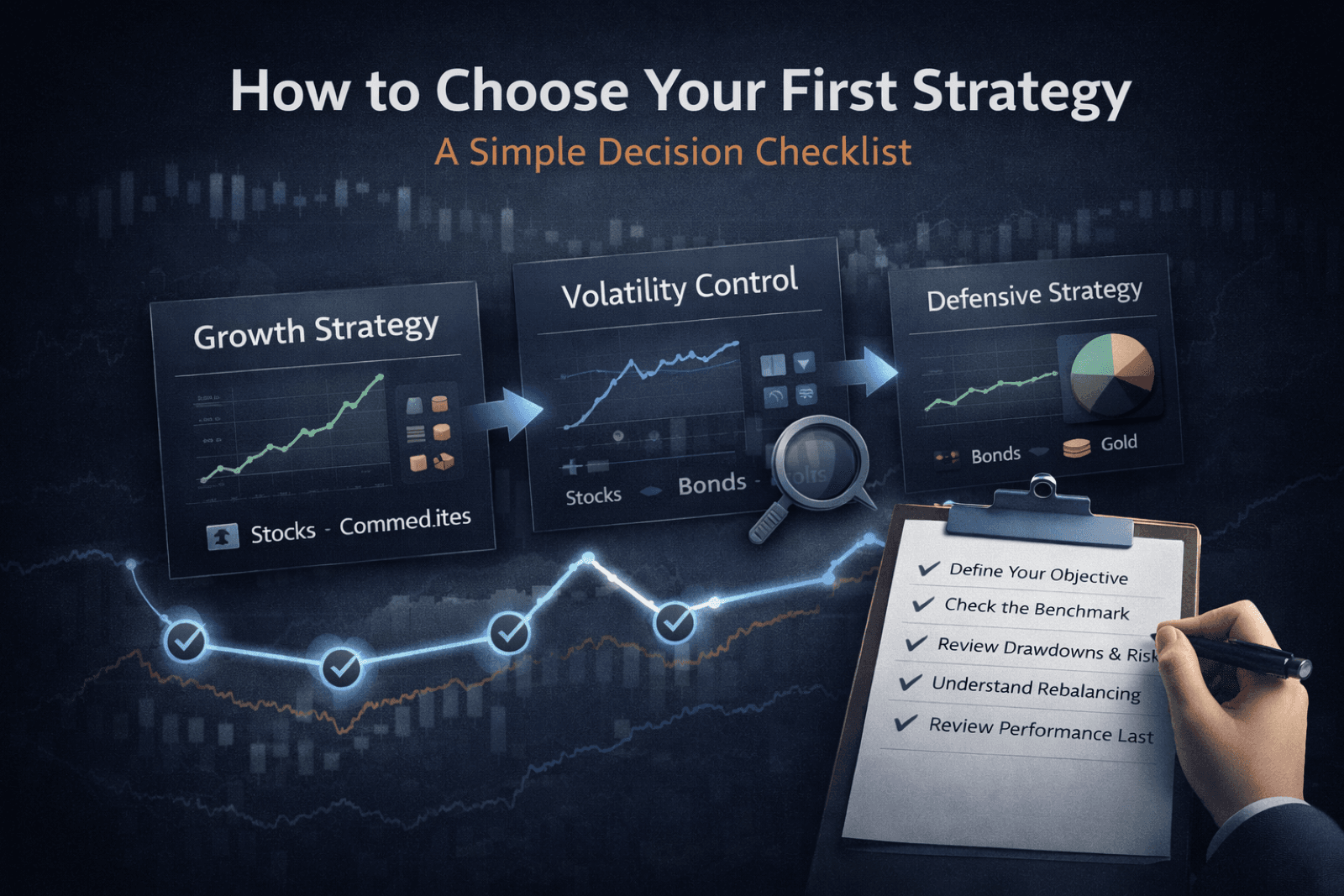

Is the strategy growth-focused, volatility-controlled, or defensive?

Does it aim to outperform a benchmark, reduce drawdowns, or stabilise returns?

Does it allocate across equities only, or include bonds, commodities, or defensive assets?

Understanding what the strategy is designed to do is more important than how it performed in any single period.

Step 2: Check the benchmark first

Every AlgoMart strategy is compared against a clearly defined benchmark, often a blended equity/bond allocation.

Before reviewing returns:

Look at the benchmark composition

Ask whether that benchmark reflects the type of exposure you are comfortable with

Compare the strategy relative to its benchmark, not to other strategies with different risk profiles

This prevents unfair comparisons and performance bias.

Step 3: Review risk metrics before performance

Focus on how the strategy behaves under stress.

Key metrics to review early:

Maximum drawdown

Annual volatility

Downside volatility

Beta relative to the benchmark

These figures help answer an important question:

How uncomfortable might this strategy feel during difficult periods?

A strategy with strong long-term results but deep drawdowns may not be suitable as a first strategy.

Step 4: Understand rebalancing and regime behaviour

AlgoMart strategies rebalance on a low-frequency schedule, typically monthly, with additional adjustments during specific market regimes.

Review:

How often the strategy reallocates

Whether it uses defensive or emergency allocations

How it historically behaved during bear markets or high-volatility periods

This helps you understand what kind of changes to expect over time.

Step 5: Use performance last—not first

Only after understanding structure, risk, and behaviour should you review:

CAGR

Long-term cumulative returns

Sharpe and Sortino ratios

Performance should confirm that the strategy behave consistently with its design, not change the rules on its own.

A simple first-strategy checklist

Many users find this checklist helpful:

I understand what the strategy is designed to do

I am comfortable with its benchmark and asset mix

I can tolerate its historical drawdowns

I understand how often it rebalances

I would be comfortable holding it during a difficult year

If you can confidently answer “yes” to all five, you are likely starting in the right place.

Important note (informational use):

All AlgoMart strategies and data are provided for informational purposes only. They do not constitute investment advice or recommendations and do not consider individual financial circumstances.

Users should conduct their own due diligence and consult qualified financial professionals where appropriate.